Tropical Temptations

By Melanie Norris, Associate Director, Fresh Industry LeadAustralia’s warm climate offers perfect growing conditions for tropical fruit. Sweet and exotic, these delicious fruits provide an opportunity to expand the repertoire of Australian households.

Tropical fruit, which includes three key segments - pineapple, papaya and lychee, increased 6.5% in volume last year, predominantly driven by the strong performance of papaya. Bolstered by the COVID-19 homebody economy where shoppers are staying and eating at home more, tropical fruit grew 14.9% in volume and 12.9% in dollar sales for the 12 weeks ending 17 May 2020. During this time, more households visited greengrocers/specialty stores to purchase tropical fruit.

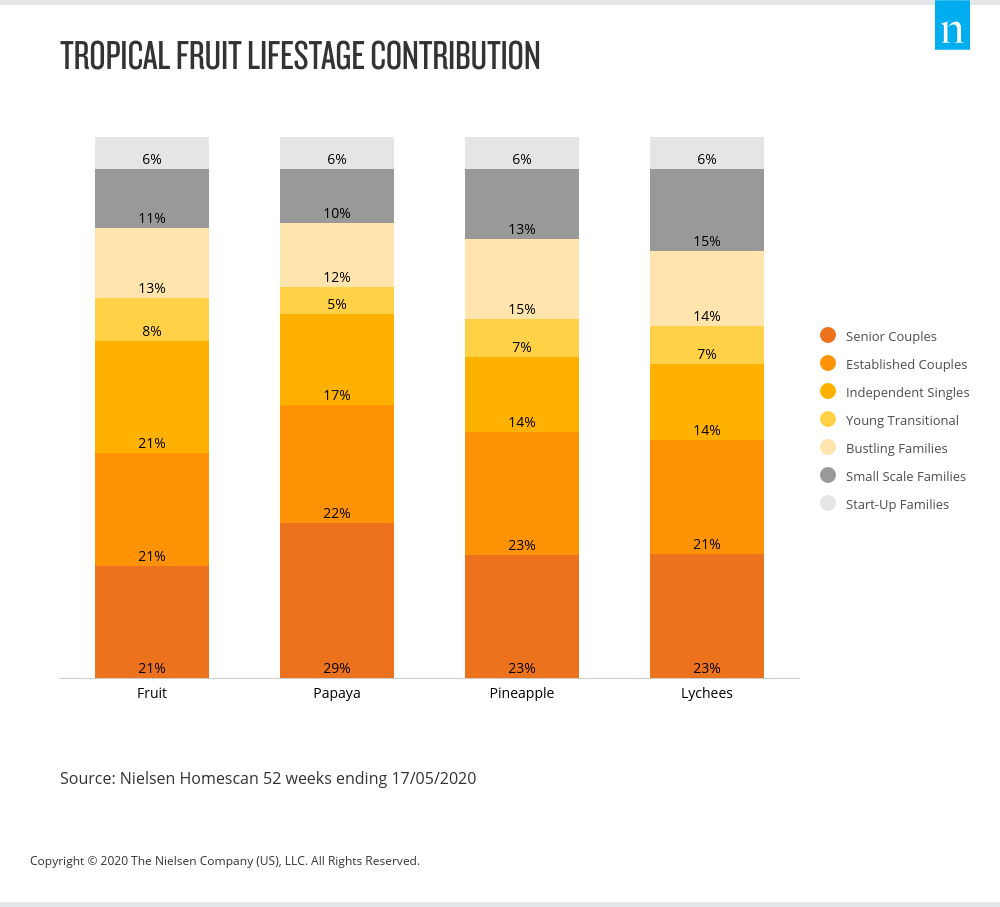

Tropical fruit buyers are committed fruit buyers spending more on the category than the average fruit buyer. East Asian, Southern and Central Asian, Middle Eastern and African households represent a larger chunk of papaya and lychee buying households, compared to the average for total fruit; while Europeans/Americans are over-represented in pineapple buying households. Single adult households with no children, who comprise 29% of the population, are generally under-represented in tropical fruit and represent a sizable opportunity. If single households aged 35+ were to increase their proportion of buying households to meet the average, it would represent $5 million in incremental category sales.

Papaya

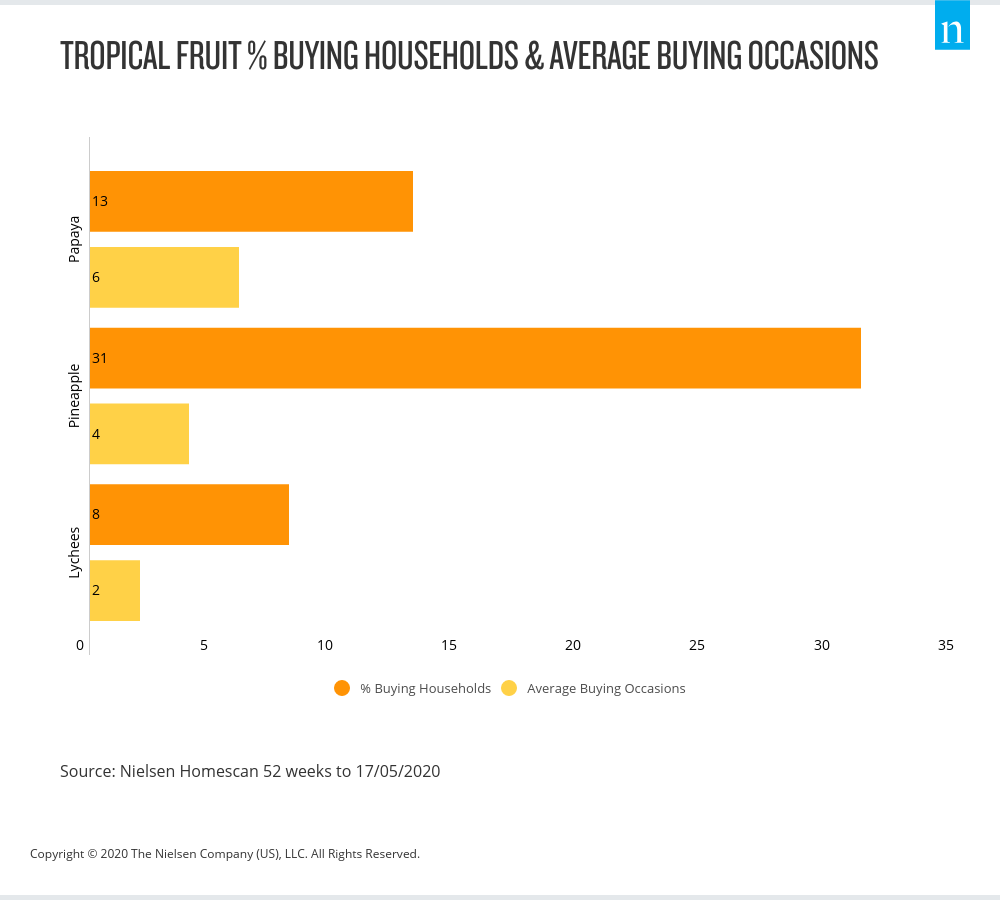

With a recent successful season, papaya grew a significant 36.6% in volume sales and 19.9% in dollar sales. This performance was the result of plentiful supply leading to increased promotions and a lower average price (-12.2%). Increased promotional presence ensured papaya got in front of more households and was put in the shopping basket more frequently. An additional 183 thousand households purchased papaya over the past year, and average frequency of purchase increased to 6 times a year.

Pineapple

Hampered by a poorer 2019 season due to supply challenges, pineapple volume consumption declined -8.4% over the past year. Average price increased 5.7%; however, this was aligned with the overall trend as the average price of fruit increased 8.1%.

Pineapple has the widest reach of the three tropical fruit segments; however, over the past year, pineapple lost 3% of buying households bringing it to 31% penetration. Pineapple lost sales across all retailer groups, but the loss in buying households was driven by major supermarkets most likely due to issues stemming from supply.

The past 12 weeks have seen a resurgence with pineapple volume growth recovering to 5.0% volume growth and a corresponding dollar growth of 4.8%.

Lychees

Lychees are a fruit many Australians are yet to taste. With only 8% of households purchasing fresh lychees, there is an opportunity to introduce the delicate flavour to more shoppers. Last year lychees declined -14.6% in volume and -5.2% in dollar sales. This decline was mainly driven by greengrocers and markets; while the average price per kg also increased significantly at 11.0%. A decrease in the number of buying households, frequency of purchase, and the amount purchased were equal contributors to this decline.

With fresh produce sales on the rise due to more households staying and eating at home due to COVID-19, tropical fruit can enliven the repertoire of Australians who may be tired of their regular fruit purchases and open to trying something new. Single households represent the main opportunity in tropical fruit and encouraging new households to purchase via in-store sampling and education will increase the reach of these fruits. With Australia’s ever-diversifying population the future looks bright for tropical fruit.

Notes:

- East Asian & South East Asian households are defined by the country of birth of the Head of Household; the main income earner coming from: China, Hong Kong, Macau, Taiwan, Japan, Korea Pakistan, Sri Lanka, India, Bangladesh, Afghanistan, Iran, South Africa, Egypt, Lebanon, Turkey (9% of the population)

- Major Supermarkets are defined here as the sum of Woolworths, Coles and ALDI

Sources:

- Nielsen Homescan 52 weeks to 17/05/2020

- https://www.abc.net.au/news/rural/2019-12-19/pineapple-crop-drops-by-40-per-cent-as-dry-weather-hits-supply/11810662